Does inflation concern you if you are approaching retirement?

Posted By RichC on December 20, 2022

By CC BY-SA 4.0, Link

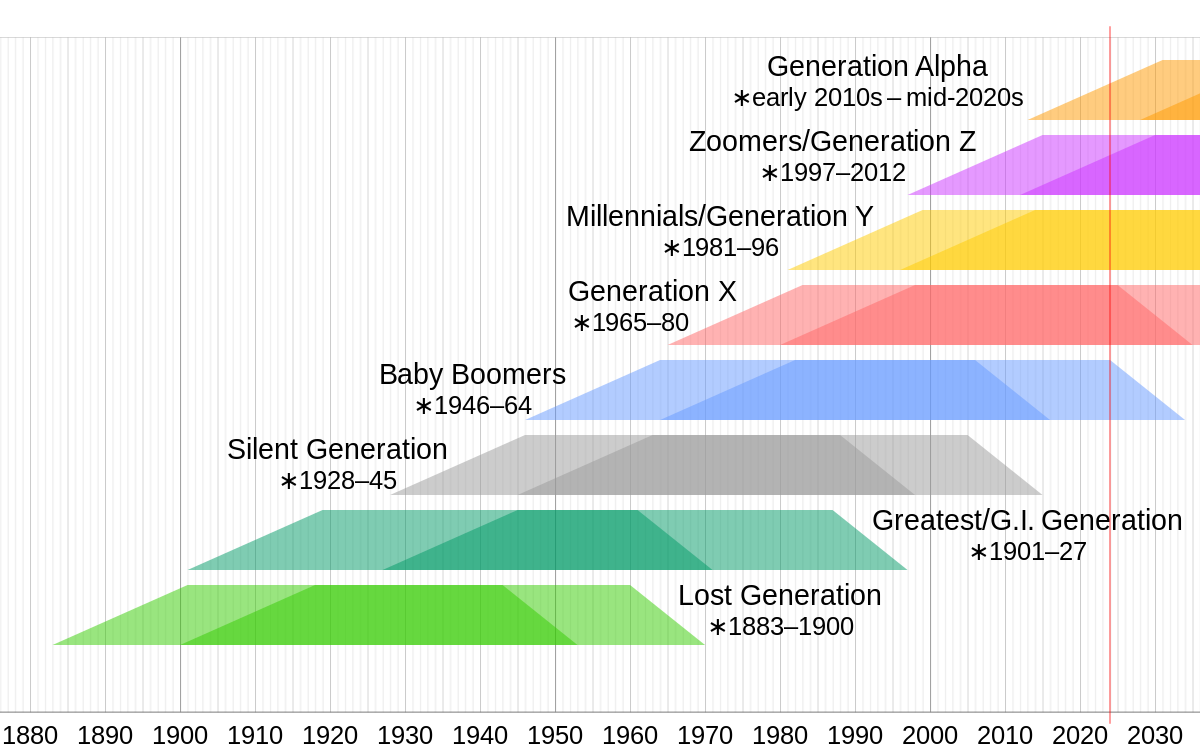

Since I’m a tail-end baby boomer, at least according to the charts, the thought of “did I plan properly for retirement” regularly crosses my mind. Having lived through the last couple of decades of economic ups and downs without significant inflation …beyond the normal and desirable 2-3% per year (except for education and health care), it does make these last couple of years of inflation rising a little more concerning.

- How long will it continue?

- Is it going to go even higher than 7-8%?

- Will savings and investments keep up?

- Do we need to cut back on expenses and lifestyle before it is too late?

Now if you say “oh don’t worry about it,” well then you might want to read “These are the top 10 mistakes people make when planning for retirement” from Market Watch earlier this month which was republished in BarronsOnline. Number 1 on this top ten list is inflation.

These are the top 10 mistakes people make when planning for retirement — See what you’re doing wrong and what you need to change.

We all make mistakes in planning for our golden years. But which are the worst, which are the most common, and which ones do we all need to watch out for?

Financial planners have weighed in with the top 10 they see among clients. It’s emerged in a survey conducted by money managers Natixis and just released. And it’s a terrific checklist for anyone who wants to see how they’re doing, and what they need to change.

The top 10:

1. Underestimating the impact of inflation (cited by 49% of advisers). This surely needs no explanation—least of all this year. The S&P 500 SPX, -0.90% is down 17.5% so far in 2022, but in real purchasing power terms the figure is much more brutal, at 22%. We cannot eat “nominal” returns, meaning returns before counting inflation. Yet we still talk about these things in nominal rather than “real” terms, which means after inflation. If inflation averages, say, 3% a year, over 25 years the purchasing power of a dollar falls by 50%. Ouch.

2. Underestimating how long you will live (46%). Cue “longevity risk.” Sure your savings can last 10 or 15 years. But what about 30?

Comments